What is first-dollar coverage?

First-dollar coverage is an insurance policy that pays healthcare costs beginning with the first service. In the Medicare world...

How does Medicare determine who is subject to paying more for Part B?

Social Security is the agency that determines who will pay the Income-related Monthly Adjustment Amount (IRMAA) for Part B, medical insurance, and Part D...

What does ‘paying secondary to Medicare’ mean?

When there is more than one payer involved in healthcare services, coordination of benefits rules apply. A secondary payer does not pay for services and items that another health insurance...

What does "first payer" mean?

The first or primary payer is the one that pays up to the limits of coverage. The first payer may not be the one that literally pays first...

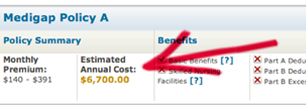

Can you explain the “estimated annual cost” for a Medigap policy?

The Medicare Plan Finder offers information about the types of Medigap policies available by zip code. In the policy summary, the second column is...

What happens if I refuse to pay the Part D IRMAA?

The Affordable Care Act mandated that higher income beneficiaries must pay an income-related monthly adjustment amount for Medicare Part D...

Should I continue to contribute to an HSA until I enroll in Medicare?

There’s no perfect answer for this question. Once enrolled in Medicare, an individual can no longer contribute to a Health Savings Account (HSA)...

Can I withdraw money from my HSA to cover Medigap premiums?

No, you cannot withdraw money for this purpose. The premium for a Medigap policy...

What is a life-changing event?

A life-changing event is connected with the Income-related Monthly Adjustment Amount (IRMAA)...

Can you explain the out-of-pocket limit?

Medicare Advantage plans must limit how much their members pay out-of-pocket for covered Medicare expenses...

How do I pay the Part B premium?

For those who receive Social Security, Railroad Retirement Board benefits, or Civil Service benefits, the premium for Part B, medical insurance, is deducted...

Do you pay more in Medicare Part B premiums?

Many people pay increased Medicare premiums without knowing it. Are you one of these people? Find out if you're paying a higher amount for Medicare Part B with our free IRMAA detection tool.

Calculating Medicare’s hospital deductibles and copays

Anyone going into the hospital knows there will be a bill coming on the way out. But for Medicare beneficiaries...

“I received a letter from Social Security saying that I must pay more for Medicare Part B.”

Higher-income beneficiaries must pay more for Medicare Part B, medical insurance. This letter lets you know you are one of those higher-income beneficiaries...

Learn how to compare Original Medicare and Medicare Advantage

In Medicare, a $0 premium does NOT mean $0 out-of-pocket costs. Learn how to compare the potential out-of-pocket costs of both Original Medicare and Medicare Advantage BEFORE you choose your Medicare path...

Medicare & HSAs: 3 facts you need to know

If you’re turning 65 years of age, have a Health Savings Account (HSA), and plan on enrolling in Medicare, here are some important facts to consider...

The difference between copayments and coinsurance

Copayments and coinsurance can apply to almost any healthcare service or prescription medication. A copayment is a...

Medicare Announces Costs, Part B Premium

Beneficiaries will pay more for some parts of Medicare coverage in the new year...

How much does Medicare cost?

There are two ways to get Medicare coverage: Original Medicare and Medicare Advantage. The cost of Medicare depends on the approach...

Can distributions from an HSA pay Medicare premiums?

Once enrolled in Medicare, beneficiaries can no longer contribute to a Health Savings Account (HSA), but can they use the funds to pay qualified Medicare expenses? Find out...

Can someone who doesn't qualify for Medicare purchase the coverage?

Individuals who did not work enough quarters to qualify for premium-free Part A can still purchase this Medicare coverage if they meet certain criteria...